38 coupon vs interest rate

What's Happening With UK Mortgage Rates? - Forbes Advisor UK The Bank of England raised interest rates in September from 1.75% to 2.25%. The 0.5 percentage point increase marks the seventh rise since December 2021 wh Singapore Savings Bonds (Oct 2022): Interest Rate, How To Buy SSB Singapore Just to give you an idea of how much to expect: the 10-year SGS has mostly yielded between to 2 to 3% over the past 10 years, with the current yield being 2.4%. Assuming a S$10,000 investment, this gives an average interest of $240 a year or $20 a month, over 10 years. Illustration Credit:: MAS.

4 Best Personal Loans Offered By Credit Unions In October 2022 - CNBC Personal loans are a popular way to fund large expenses because they typically carry lower interest rates compared to credit cards, can provide as much as $100,000 in funding and can be used for ...

Coupon vs interest rate

Best CD Rates of October 2022 - CNBC The national average rate for a 3-year CD is 0.26% APY, according to the FDIC. With a fixed interest rate of 0.75%, the First National Bank of America CD offers an APY that's more than double ... All the 21 Types of Bonds | General Features and Valuation | eFM 13.06.2022 · Coupon. The rate of interest paid on the bond is called a coupon. (Read more about it at Coupon Rate).. Rating. Credit rating agencies usually rate every bond; the higher the credit rating, the lower the coupon required to pay by the issuer and vice versa.. Coupon Payment Frequency. The coupon payments on the bond usually have a payment frequency. Yield vs. Interest Rate: What's the Difference? - Investopedia 17.12.2021 · Here, the interest rate is also known as the coupon rate. This rate represents the regular, periodic payment based on the borrowed principal that the investor receives in return for buying the bond.

Coupon vs interest rate. How Interest Rates Affect the Insurance Sector - Investopedia If interest rates rise to 5%, then the insurance company will ultimately lose out and have a harder time selling the bond. However, the reverse could also be true, if the insurance company has... RBI repo rate hike by 50bps: What this means for fixed deposit interest ... To reduce the prolonged above-target retail inflation rate, the Reserve Bank of India (RBI) increased the repo rate by 50 basis points to 5.90%, the fourth consecutive increase in the current cycle. RBA Cash Rate 2022: Current Interest Rates Australia - Savings.com.au Current RBA cash rate: 2.6%. The cash rate is Australia's official interest rate which is currently held at a target of 2.6% by the Reserve Bank of Australia (RBA). The cash rate is determined by the Reserve Bank of Australia in a board meeting every month (excluding January). This rate is the rate charged on loans between financial ... Mortgage Rates: Compare Today's Rates | Bankrate 3.23%. See all refinance rates. For today, Tuesday, February 15, 2022, the average rate for a 30-year fixed mortgage is 4.20%, an increase of 27 basis points since the same time last week. If you ...

Interest Rate Parity Formula & Types | What is Interest Rate Parity ... The interest parity equation is used to calculate the forward exchange rate between two currencies. It can be represented as: Fo = So * ( (1+a)/ (1+b))^n Fo = Forward rate after n periods. So =... Treasury Inflation-Protected Securities | TIPS: Perfect investment for ... This demand will probably continue into 2023 with a new variable rate somewhere around 6.2% to 6.4%. This is from a Barron's article on the boom in demand in I Bonds: "The average monthly issuance of $2.7 billion so far in 2022 compares with monthly sales of just $30 million in early 2021 when the rate was just 1.7%." The fairness issue Credit Union and Bank Promotions - Deposit Accounts 18-Month Bump Certificate Limited Time Offer: 4.00% APY¹ ... Interest Rate In Account Shows 2.710 %. Bask Bank. Posted by: enduser Sep 22, 2022 | 10 comments. UFB Elite Savings Increased To 3.01%. UFB Direct. Posted by: evol97 Oct 1, 2022 | 3 comments. 4.05% 14 Month Promo CD. INOVA Federal Credit Union. October 2022 30 Year Fixed | Fannie Mae october 2022 30 year fixed mandatory delivery commitment mandatory delivery commitment 30-year fixed rate a / a. date: time: 10-day: 30-day: 60-day: 90-day: 10/03/2022: 08:15

Best Money Market Accounts in October 2022 - MagnifyMoney UFB Direct offers competitive rates on deposit accounts, as well as a variety of home loans. UFB Direct's money market account offers 2.61% APY on all balances. The minimum requirement to open is only $250, but you'll want to maintain a $5,000 balance to avoid a $10 monthly fee. Account holders will receive check-writing privileges. 14 Best CD Rates for October 2022 - NerdWallet You can find rates far higher than the national averages of 0.60% for one-year terms and 0.74% for five-year terms. The Federal Reserve has raised its rate multiple times in 2022, leading banks to... 10 Best Savings Rates of October 2022 - NerdWallet The best savings interest rates might mean the difference between your savings account earning a decent chunk of cash or only a few dollars in a year. The highest interest rates are significantly... Best Auto Loan Rates - Forbes Advisor Minimum rate 3.49% Loan amount Starts at $7,500 (no max) Minimum credit score 620 Why We Picked It Pros & Cons Extra Details Digital Federal Credit Union (DCU) 3.7 Minimum rate 3.24% Loan amount...

Best Online Checking Accounts for October 2022 - CNET Axos Bank. Axos Bank offers checking, savings, money market accounts and CDs. Of the three types of checking accounts, the Rewards Checking account will pay up to 1.25% APY with direct deposit ...

SBI FD vs Post Office deposit vs Kisan Vikas Patra: Latest interest rates According to the bank's official website, the fixed deposits maturing in seven days to 10 years offer an in interest rate ranging from 2.90 % to 5.65% to general customers and 3.4% to 6.45% to ...

Yield to Maturity vs. Coupon Rate: What's the Difference? 20.05.2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ...

South Africa Government Bonds - Yields Curve 10 Years vs 2 Years bond spread is 353.5 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 6.25% (last modification in September 2022). The South Africa credit rating is BB-, according to Standard & Poor's agency. Current 5-Years Credit Default Swap quotation is 313.76 and implied probability of default is 5.23%.

What Is the Discount Rate? | The Motley Fool The impact of the discount rate on the economy is much more complex. The discount rate sets an upper bound on how much banks will pay to borrow cash to meet their reserve requirements. The lower ...

Simple vs. Compound Interest | The Motley Fool Interest on credit card balances typically compounds daily. If your annual interest rate is 18%, then you are paying a daily interest rate of 0.0493%. Suppose you carry a $5,000 balance. After one...

corporatefinanceinstitute.com › interest-rateInterest Rate - Calculate Simple and Compound Interest Rates May 07, 2022 · The real rate of return on an interest-bearing account is the nominal interest rate MINUS the rate of inflation. The stated interest rate is just the “nominal” rate, meaning “in name only” – i.e., not the REAL rate being earned. Factors Affecting Interest Rates 1. Forces of demand and supply. Interest rates are influenced by the ...

Interest Rate - Calculate Simple and Compound Interest Rates 07.05.2022 · Fixed vs. Floating (Variable) Rate. Interest rates can be fixed, where the rate remains constant throughout the term of the loan, or floating, where the rate is variable and can fluctuate based on a reference rate. More information regarding these two types of loan features can be found in the following article: Loan Features. Cost of Borrowing. The interest expense …

› coupon-vs-yieldCoupon vs Yield | Top 5 Differences (with Infographics) The coupon rate remains fixed for the entire duration of a bond as the coupon payment is fixed, and also the face value is fixed. Yield changes with the change in the market price of a bond. Effect of interest rate: Change in the interest rate in the economy by the central bank has no effect on the coupon rate of a bond.

Best CD Rates for October 2022 - Investopedia CIT Bank 11 months CD. 2.75% APY Rate as of 10/05/2022. $1,000. Earn a 2.75% APY with an 11-month, no-penalty CD. Enjoy no monthly service fees and no penalty if you access funds before maturity ...

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total …

Home Equity Line of Credit (HELOC) Rates for October 2022 Currently, the average interest rate for a HELOC is 7.12%, according to Bankrate. How do I qualify for a HELOC? To qualify for a HELOC, you must have good credit, at least 15% to 20% equity in your...

Best Bank Account Bonuses For October 2022 | Bankrate Best checking account bonuses. Citibank: up to $2,000 bonus. Fifth Third Bank: $250 bonus. BMO Harris: up to $350 bonus. SoFi: up to $300. TD Bank: up to $300. M&T Bank: up to $200 bonus. Chase ...

United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 3.897% yield. 10 Years vs 2 Years bond spread is 0.6 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 2.25% (last modification in September 2022). The United Kingdom credit rating is AA, according to Standard & Poor's agency.

Coupon vs Yield | Top 5 Differences (with Infographics) Key Differences. For the calculation of the coupon rate, the denominator is the face value of the bond, and for the calculation of the yield Calculation Of The Yield The Yield Function in Excel is an in-built financial function to determine the yield on security or bond that pays interest periodically. It calculates bond yield by using the bond's settlement value, maturity, rate, price, …

› ask › answersYield vs. Interest Rate: What's the Difference? - Investopedia Dec 17, 2021 · If the nominal rate is 4% and inflation is 2%, the real interest rate will be 2% (4% – 2% = 2%). When inflation rises, it can push the real rate into the negative.

Current Mortgage Rates | Best Interest Rates Today | KeyBank - Key.com View our refinance rates. Get Your .25% Interest Rate Discount 1 2 Contact us. We'll walk you through your options. With your rates, terms and benefits in hand, you'll have everything you need to take the next step. Ask questions, explore your options. Call us or schedule a time to have us call you. 1-888-KEY-0018 TDD/TTY: 1-800-539-8336

UN calls on Fed, central banks to rethink interest rate hikes Overall, UNCTAD revised down its 2022 global growth projection to 2.5% from the earlier 2.6% estimated in its March assessment. It expects growth of 2.2% in 2023. The International Monetary Fund...

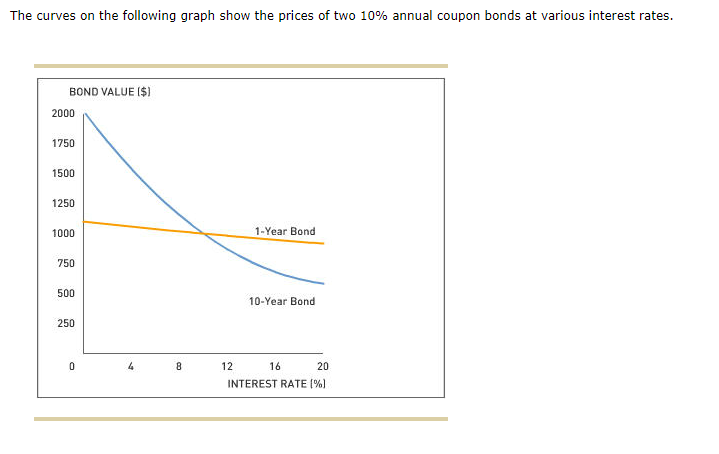

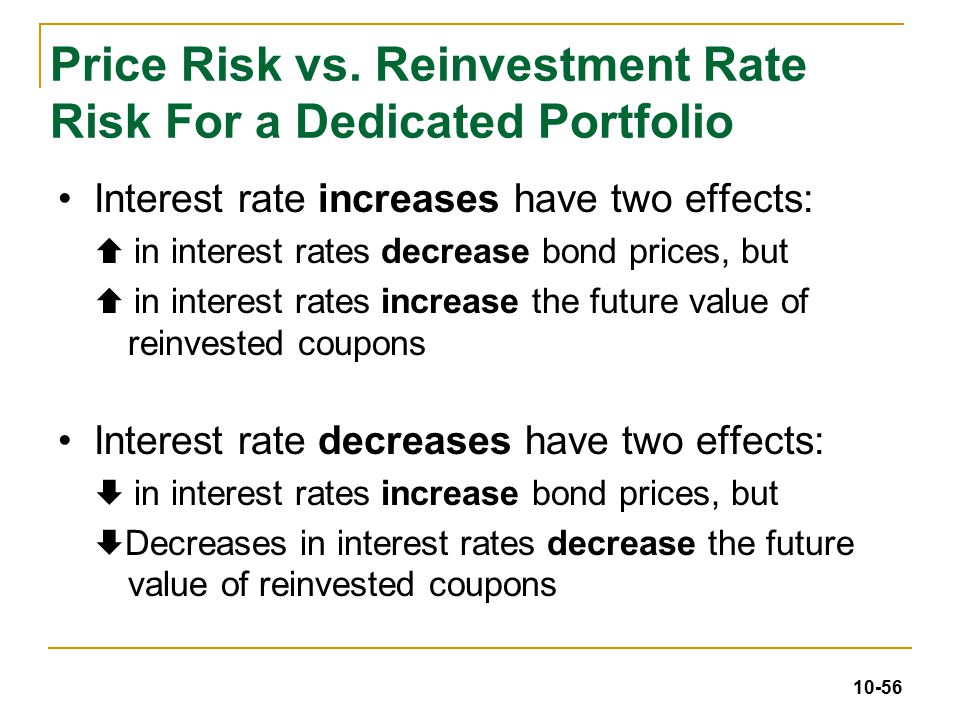

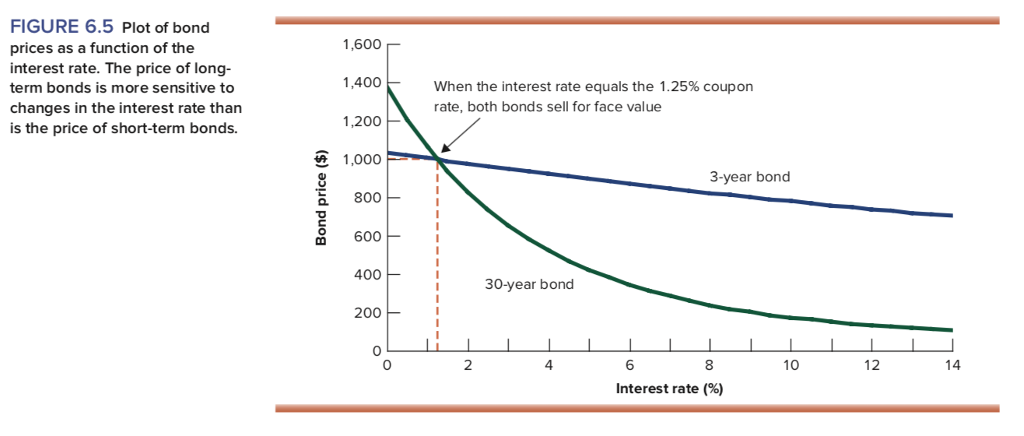

What Is Duration of a Bond? - TheStreet Definition - TheStreet For example, if interest rates rose by 2%, a 10-year Treasury with a coupon of 3.5% and a duration of 8.4 years would fall in value by 15%. Long-Term Bonds Let's use the 30-year Treasury with 4.5%...

› interest-rate-swapsInterest Rate Swaps Explained – Definition & Example Sep 14, 2021 · How Interest Rate Swaps Work. Generally, the two parties in an interest rate swap are trading a fixed-rate and variable-interest rate. For example, one company may have a bond that pays the London Interbank Offered Rate (LIBOR), while the other party holds a bond that provides a fixed payment of 5%. If the LIBOR is expected to stay around 3% ...

dqydj.com › bond-convexity-calculatorBond Convexity Calculator: Estimate a Bond's Yield ... - DQYDJ Bond duration is also a measure of a bond's sensitivity to interest rate changes. Modified duration is the estimate of the price change of the bond for a 1% move in interest rates. However, the duration is only a linear approximation. Specifically, the duration is the first derivative of the bond's price as it relates to interest rate changes.

Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Annual Coupon Rate (%) - The annual interest rate paid on the bond's face value. Coupon Payment Frequency - How often the bond pays out interest every year. Calculator Outputs. Yield to Maturity (%): The yield you'd recognize holding the bond until maturity (assuming you receive all payments). Macaulay Duration (Years) - Weighted average time (in years) for a payout from …

Interest Rate Swaps Explained – Definition & Example - Money … 14.09.2021 · How Interest Rate Swaps Work. Generally, the two parties in an interest rate swap are trading a fixed-rate and variable-interest rate. For example, one company may have a bond that pays the London Interbank Offered Rate (LIBOR), while the other party holds a bond that provides a fixed payment of 5%. If the LIBOR is expected to stay around 3% ...

› zero-coupon-bondZero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far.

› ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ...

Yield vs. Interest Rate: What's the Difference? - Investopedia 17.12.2021 · Here, the interest rate is also known as the coupon rate. This rate represents the regular, periodic payment based on the borrowed principal that the investor receives in return for buying the bond.

All the 21 Types of Bonds | General Features and Valuation | eFM 13.06.2022 · Coupon. The rate of interest paid on the bond is called a coupon. (Read more about it at Coupon Rate).. Rating. Credit rating agencies usually rate every bond; the higher the credit rating, the lower the coupon required to pay by the issuer and vice versa.. Coupon Payment Frequency. The coupon payments on the bond usually have a payment frequency.

Best CD Rates of October 2022 - CNBC The national average rate for a 3-year CD is 0.26% APY, according to the FDIC. With a fixed interest rate of 0.75%, the First National Bank of America CD offers an APY that's more than double ...

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

![Difference Between Coupon Rate and Interest Rate [Updated 2022]](https://askanydifference.com/wp-content/uploads/2021/04/Coupon-Rate-vs-Interest-Rate.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "38 coupon vs interest rate"