39 what is coupon for bond

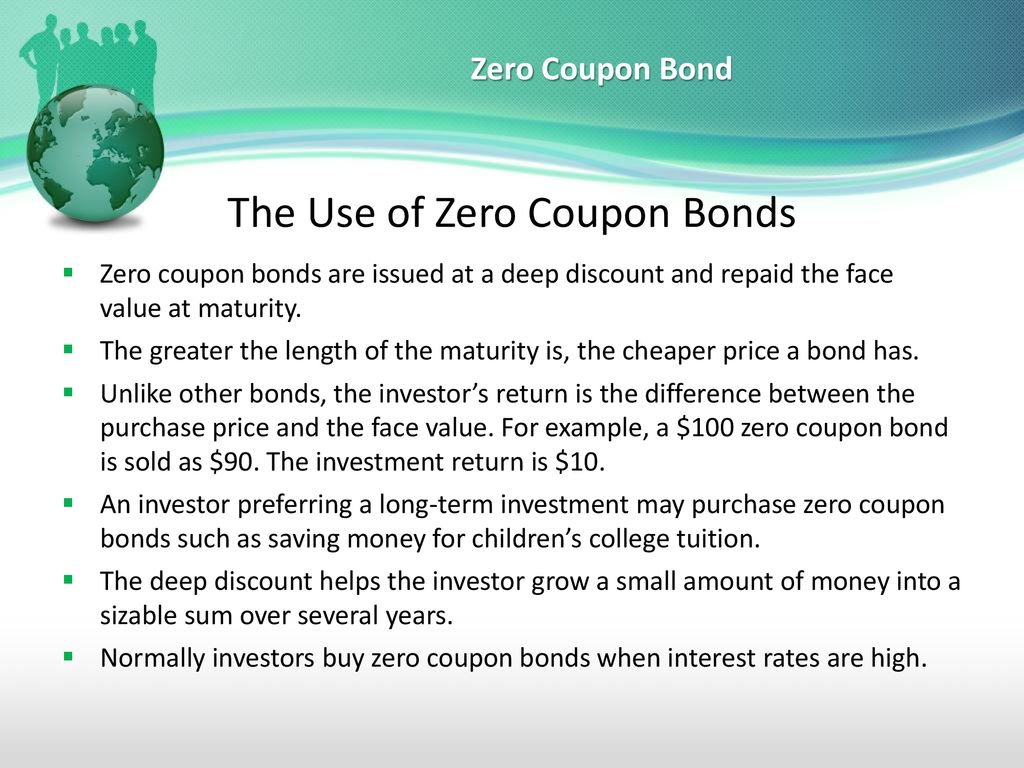

What Is a Zero-Coupon Bond? - Investopedia Payment of interest, or coupons, is the key differentiator between a zero-coupon and regular bond. Regular bonds, which are also called coupon bonds, pay interest over the life of the bond and also... What Is a Zero-Coupon Bond? | The Motley Fool Zero-coupon bonds compensate for not paying any interest over the life of the bond by being available for far less than face value. Put another way, without a deep discount, zero-coupon bonds ...

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

What is coupon for bond

Zero Coupon Bond | Investor.gov Glossary Zero Coupon Bond Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. How to Calculate the Price of Coupon Bond? - WallStreetMojo Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Perhaps the most familiar zero-coupon bonds for many investors are the old Series EE savings bonds, which were often given as gifts to small children. These bonds were popular because people could...

What is coupon for bond. Coupon Bond Formula | Examples with Excel Template - EDUCBA The term "coupon" refers to the periodic interest payment received by bondholders and bonds that make such payments are known as coupon bonds. Typically, the coupon is expressed as a percentage of the par value of the bond. Coupon bond definition — AccountingTools What is a Coupon Bond? A coupon bond has interest coupons that the bond holder sends to the issuing entity or its paying agent on the dates when interest payments are due. Interest payments are then made to the submitting entity. The interest coupons are normally due on a semi-annual basis. What Is Coupon Rate and How Do You Calculate It? - SmartAsset What Is Coupon Rate and How Do You Calculate It? Bond coupon rate dictates the interest income a bond will pay annually. We explain how to calculate this rate, and how it affects bond prices. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is. Price = M / (1+r)n. where: M = maturity value or face value of the bond. r = rate of interest required. n = number of years to maturity. 3.

Coupon (Bonds) - Explained - The Business Professor, LLC A coupon is the amount an investor receives for each acquired bond depending on the percentage initially associated with it. For instance, a bond with a face value of $5000 at 4% interest yield per annum will pay a coupon of $200 yearly and $100 per coupon payment since it is done semi-annually. The ability to trade bonds before they mature ... Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers. Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity... Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate Coupon Rate is referred to the stated rate of interest on fixed income securities such as bonds. In other words, it is the rate of interest that the bond issuers pay to the bondholders for their investment. It is the periodic rate of interest paid on the bond's face value to its purchasers.

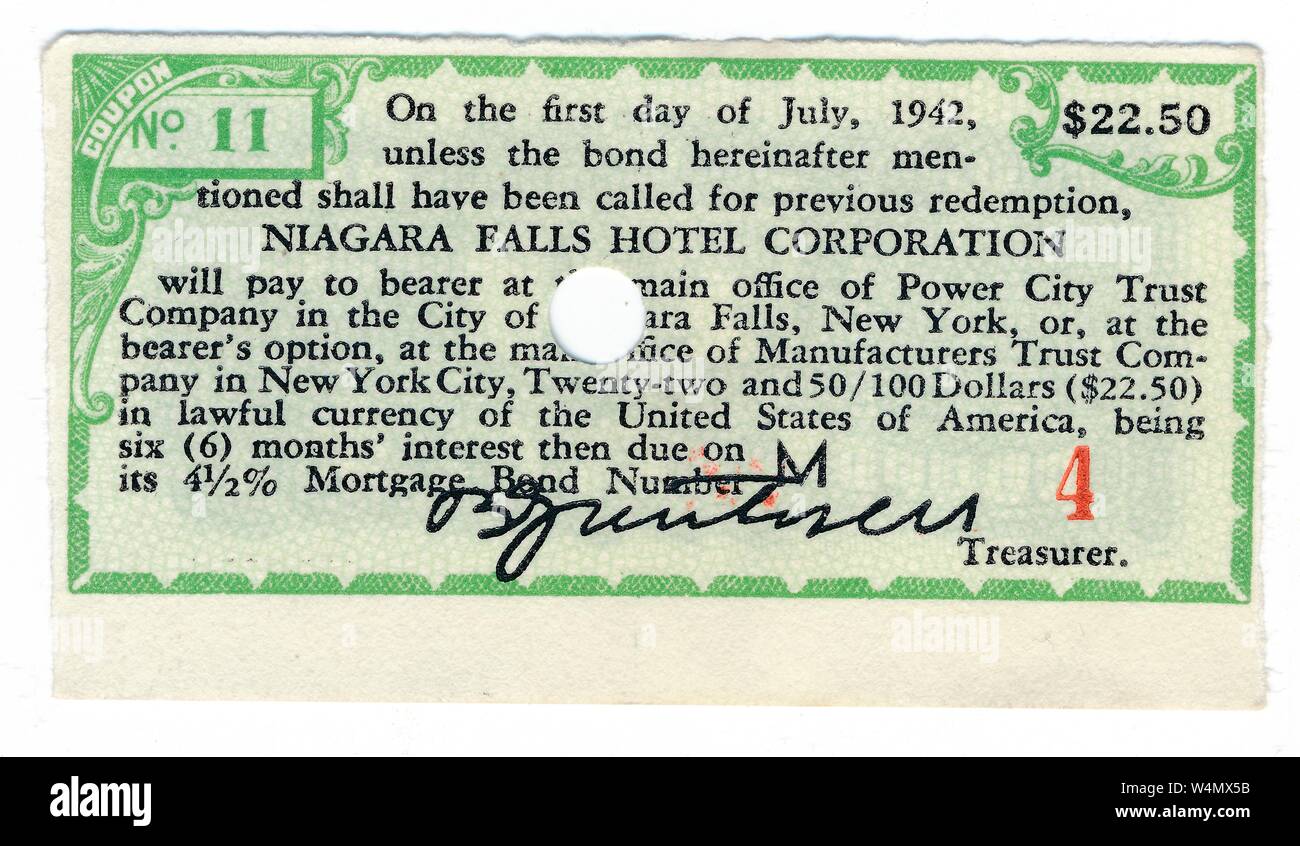

Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA The term "coupon bond" (CB) refers to the type of bond which includes coupons that are paid periodically (mostly semi-annual or annual) from the time of issuance until the maturity of the bond. These bonds come with a par value and a coupon rate, which is the bond's yield at the time of issuance. What is a Coupon Bond? - Definition | Meaning | Example Definition: A coupon bond is a debt instrument that has detachable slips of paper that can be removed from the bond contract itself and brought to a bank or broker for interest payments. These detachable slips of paper are called coupons and represent the interest payments due to the bondholder. Each coupon has its maturity date printed on it. James Bond - Wikipedia Fleming endowed Bond with many of his own traits, including sharing the same golf handicap, the taste for scrambled eggs, and using the same brand of toiletries. Bond's tastes are also often taken from Fleming's own as was his behaviour, with Bond's love of golf and gambling mirroring Fleming's own. Fleming used his experiences of his career in ... What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the nominal or stated rate of interest on a fixed income security, like a bond. This is the annual interest rate paid by the bond issuer, based on the bond's face value. These interest payments are usually made semiannually. This article will discuss coupon rates in detail.

Coupon Bond - Investopedia A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments. With coupon bonds, there are no records of...

What Is a Zero-Coupon Bond? Definition, Advantages, Risks Typically, bondholders make a profit on their investment through regular interest payments, made annually or semi-annually, known as "coupon payments." But as the name suggests, zero-coupon bonds...

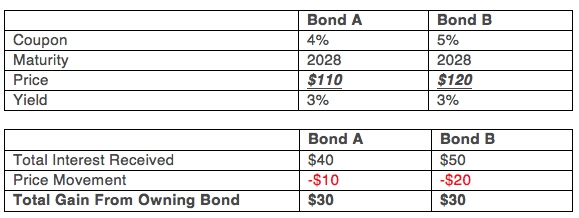

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a percentage of its par value. The par value...

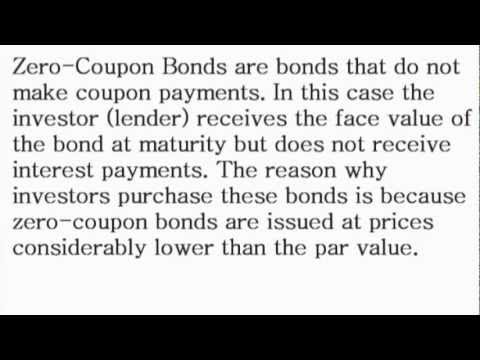

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value.

Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

PIMCO 25+ Year U.S. Treasury Index ETF's Underperformance Explained Looking through bond fund screeners, the PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund ( NYSEARCA: ZROZ) caught my eye. ZROZ has been the worst-performing bond fund of the ...

What Are Zero Coupon Bonds? Valuable Insights | TradeSmart Pricing of zero coupon bond. You might be wondering how the price of a zero coupon bond i s calculated. Here are the details based on the zero coupon bonds calculation of price is done: Zero Coupon Bond Price = M / (1+r)n, Where M is the bond's maturity value or face value, r is the needed interest rate, and n is the number of years before ...

How Do Zero Coupon Bonds Work? - SmartAsset What Is a Zero Coupon Bond? A zero coupon bond is a type of bond that trades at a deep discount and doesn't pay interest. While some bonds start out as zero coupon bonds, others are can get transformed into them if a financial institution removes their coupons. When the bond reaches maturity, you'll get the par value (or face value) of the ...

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. For example, if a bond has a face value of ...

Discount Bond (Examples) | Top 2 Types of Discount Bonds - WallStreetMojo Let's take an example of a discount bond. Consider a bond listed on NASDAQ, which is currently trading at a discount. The coupon rate of the bond is 4.92. The price at the time of issuance of a bond is $100. The yield at the time of issuance is 4.92%. The current price is $79.943, which clearly shows that the bond is trading at a discount.

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance.

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

Coupon Bond - Definition, Terminologies, Why Invest? - WallStreetMojo A coupon bond is a good way of increasing your income over a period of time. Coupon bonds are subjected to taxation in the US. Hence they can be held in a tax-deferred retirement account in order to save investors on paying taxes on the future income.

Coupon Rate Calculator | Bond Coupon As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Perhaps the most familiar zero-coupon bonds for many investors are the old Series EE savings bonds, which were often given as gifts to small children. These bonds were popular because people could...

How to Calculate the Price of Coupon Bond? - WallStreetMojo Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security).

Zero Coupon Bond | Investor.gov Glossary Zero Coupon Bond Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

Post a Comment for "39 what is coupon for bond"