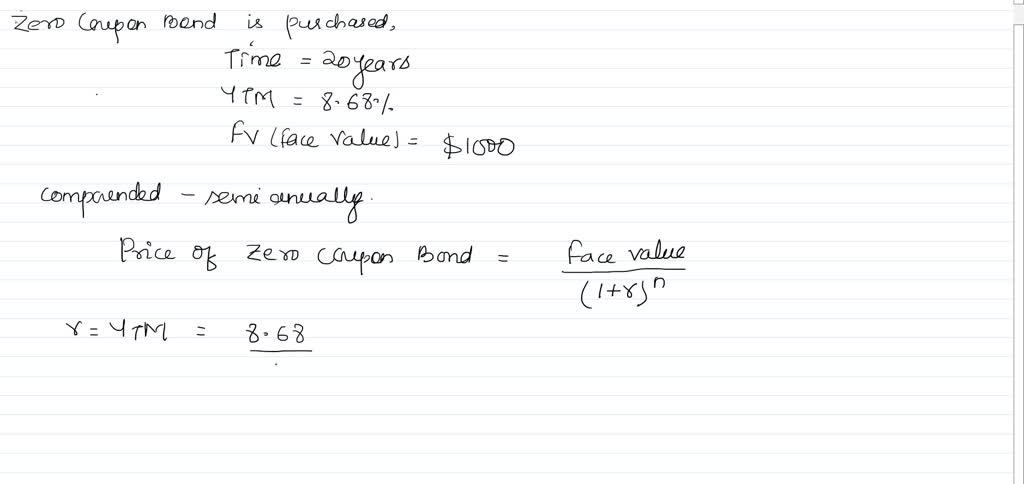

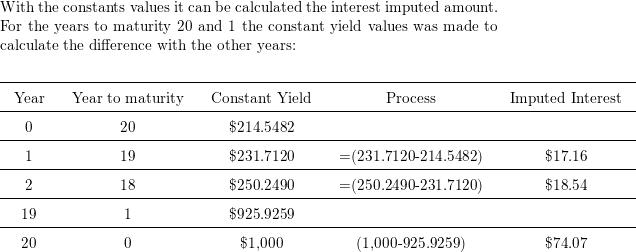

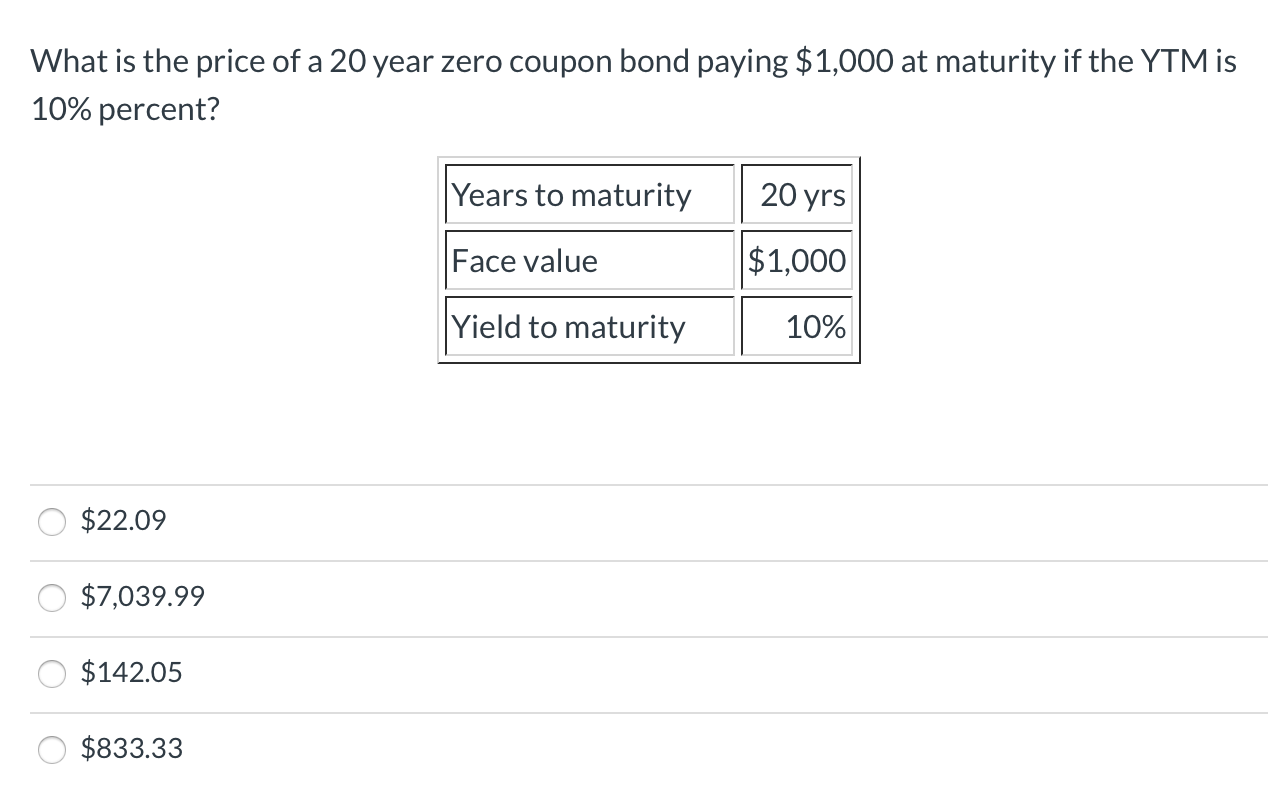

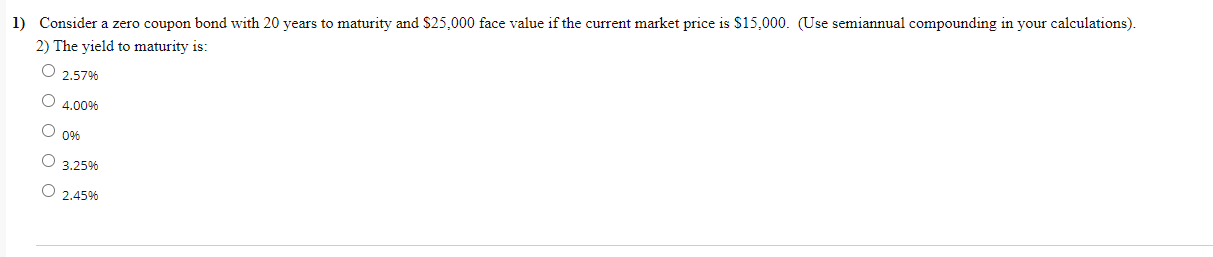

39 consider a zero coupon bond with 20 years to maturity

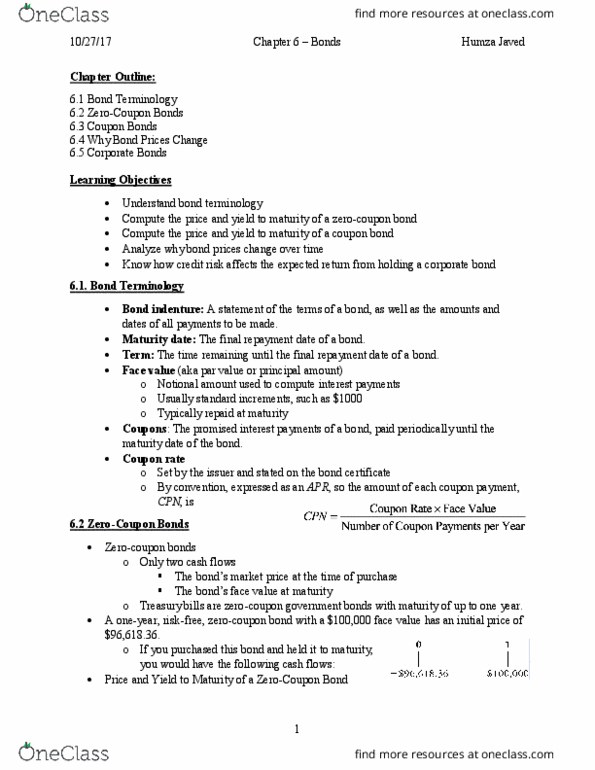

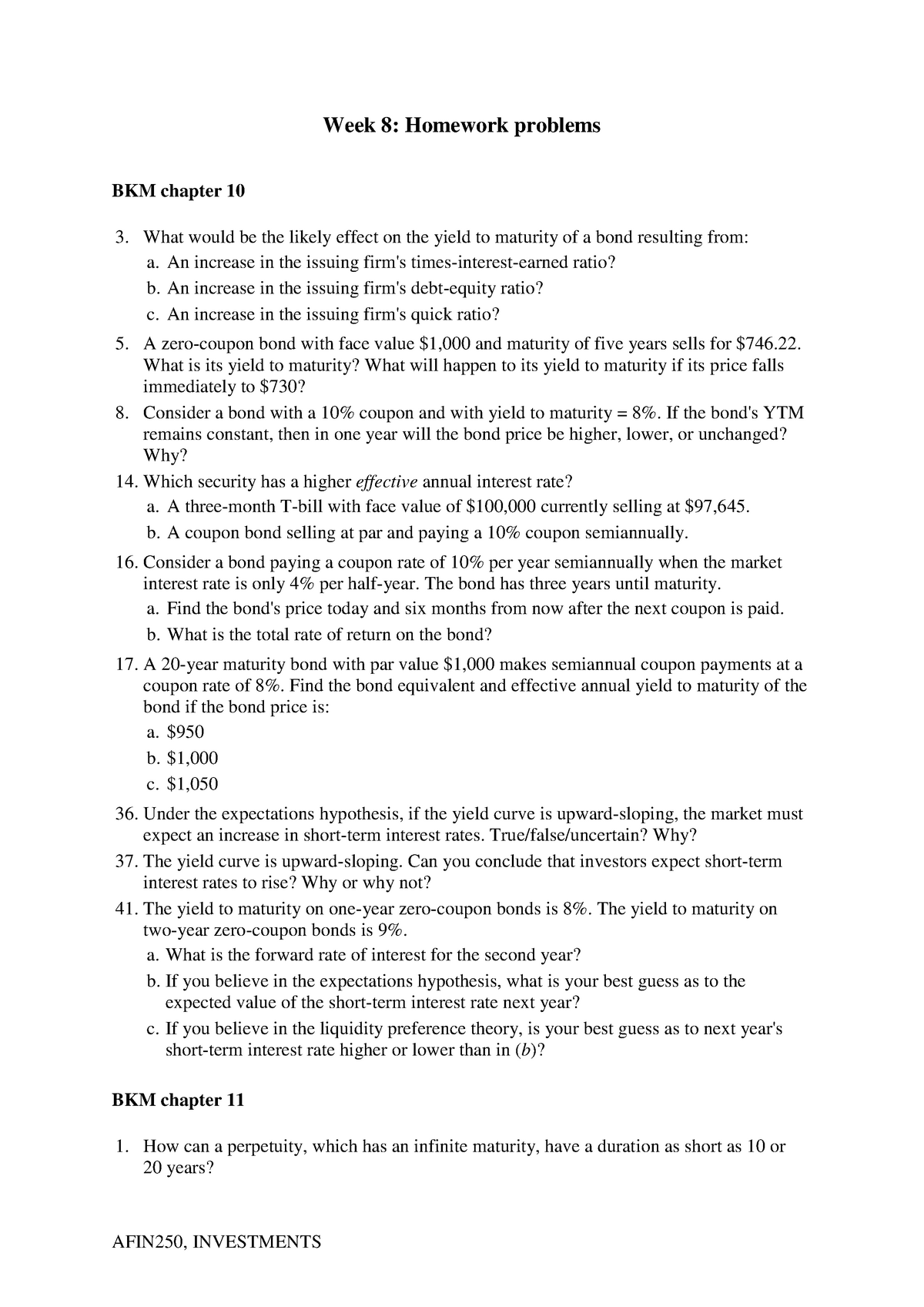

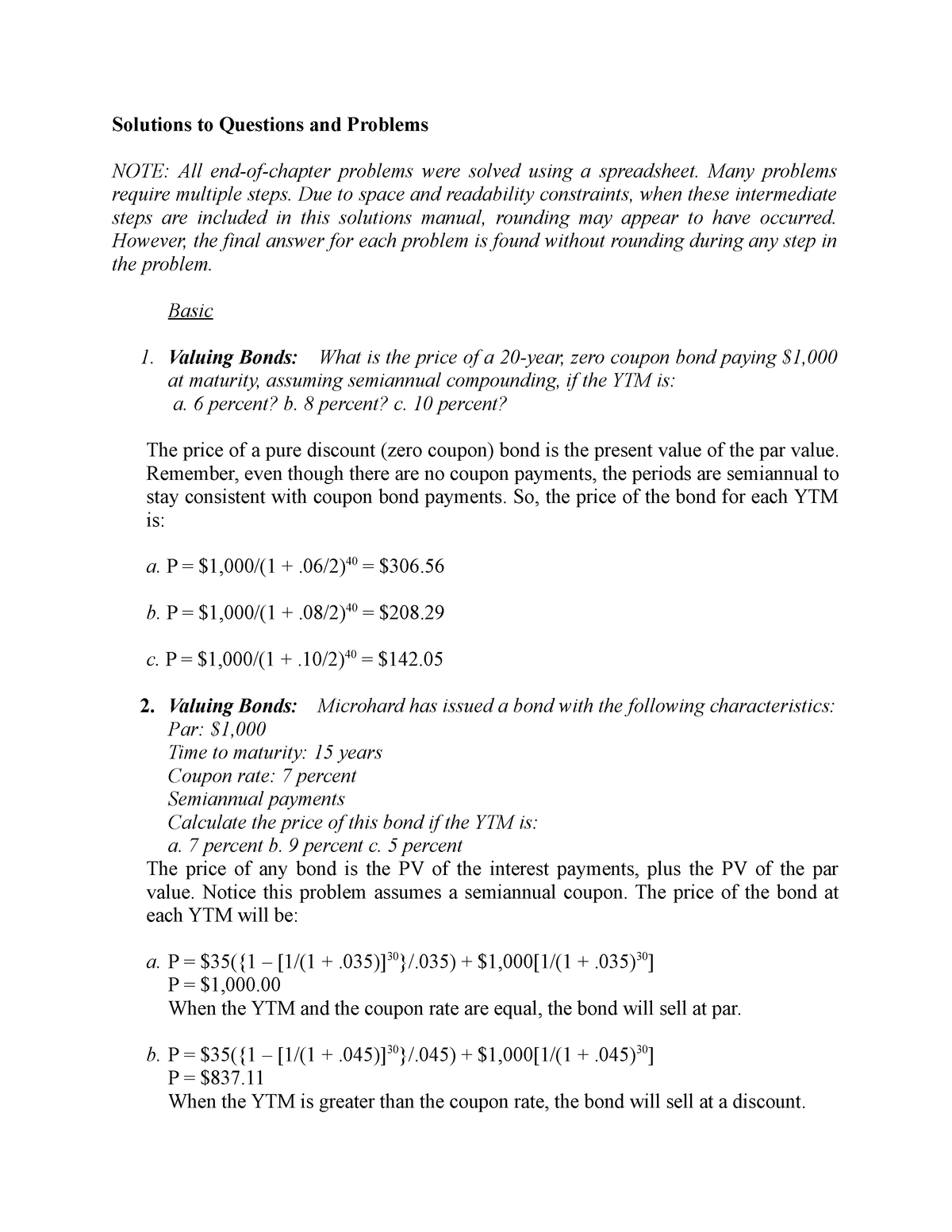

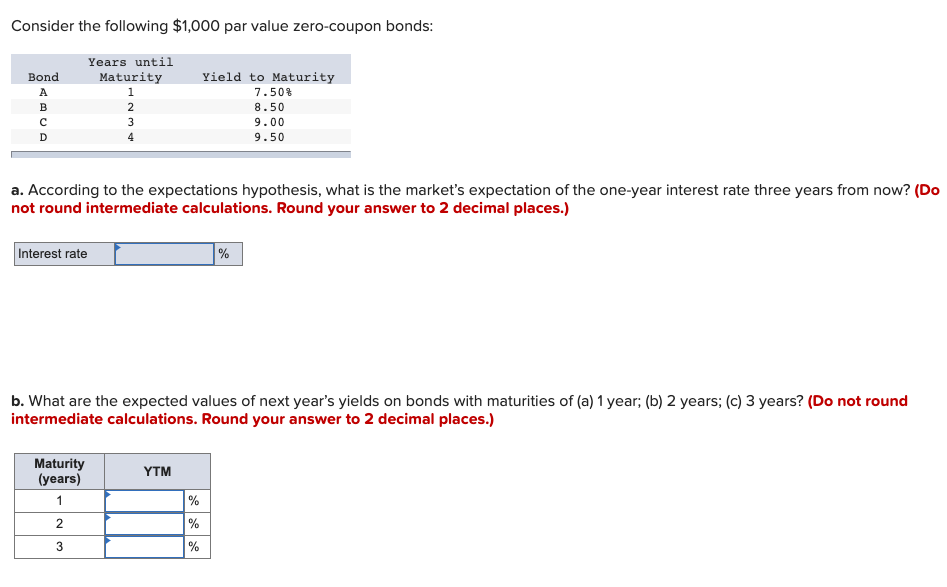

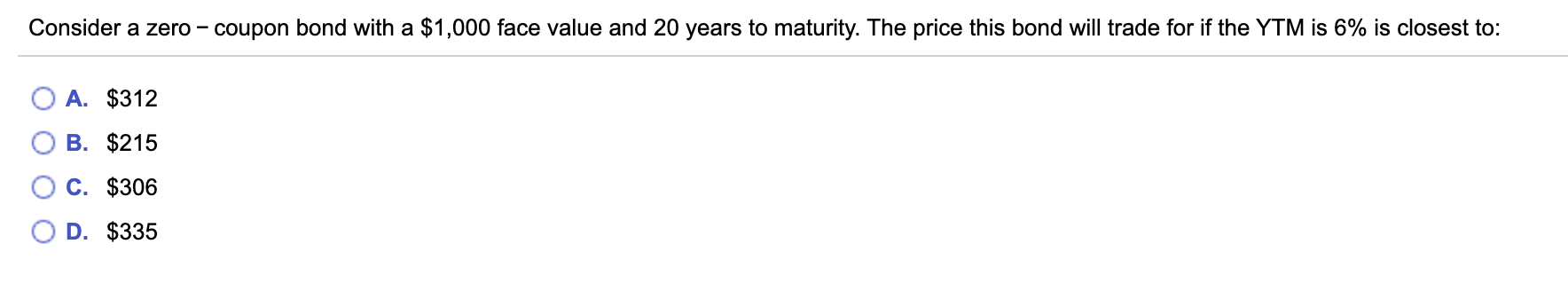

Solved Consider a zero coupon bond with 20 years to - Chegg You'll get a detailed solution from a subject matter expert that helps you learn core concepts. See Answer Consider a zero coupon bond with 20 years to maturity. The price will this bond trade if the YTM is 6% is closest to: Expert Answer 100% (1 rating) Price of a Zero coupon bond = Face value * ( 1 + r)-n Fa … View the full answer Solved 1. Consider a zero-coupon bond with 20 years to ... 1. Consider a zero-coupon bond with 20 years to maturity. What would be the price of the bond if the YTM is 6%? (semiannual compounding and 1000 of par are assumed) 2. The Morresy Company's bonds mature in 7years, have a par value of $1000 and make an annual coupon payment of $70. The market interest rate for the bonds is 8.5%.

Consider a zero coupon bond with 20 years to maturity Consider a zero coupon bond with 20 years to maturity The price will this bond from BUSI MISC at Lone Star College System, Woodlands

Consider a zero coupon bond with 20 years to maturity

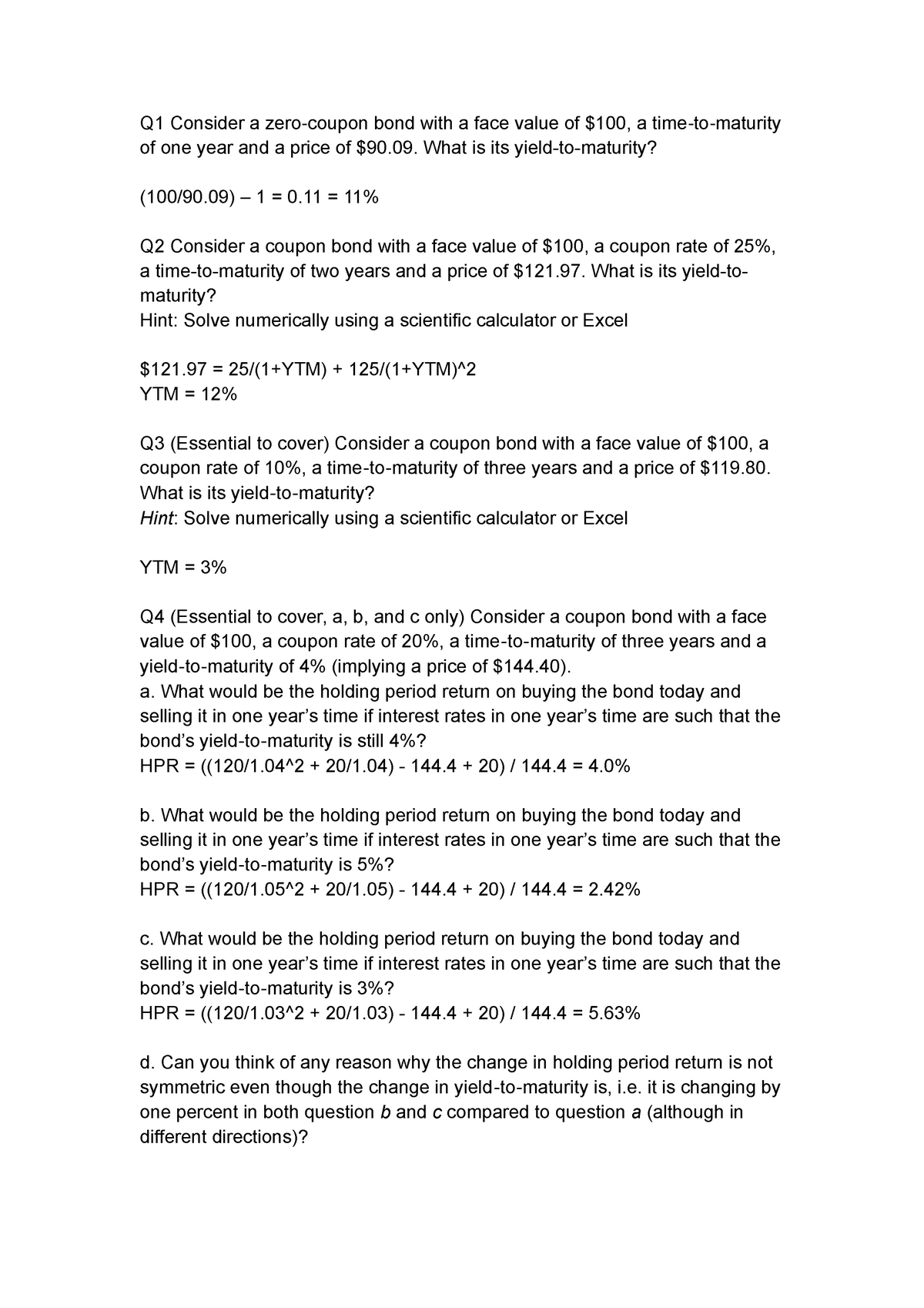

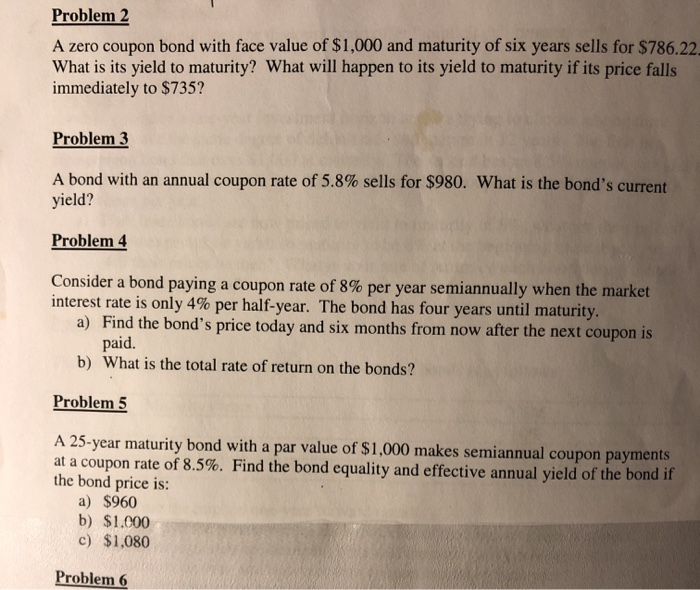

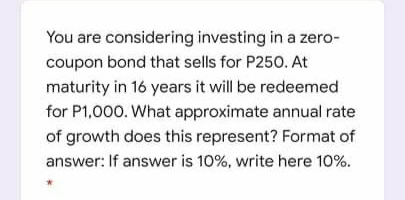

How to Calculate Yield to Maturity of a Zero-Coupon Bond Yield to maturity (YTM) is an important metric used in bond markets that describes the total rate of return that is expected from a bond once it has made all of its future interest payments and repays the original principal amount. Zero-coupon bonds (z-bonds), however, do not have reoccurring interest payments, which distinguishes YTM calculations from bonds with a coupon rate . Consider a zero coupon bond with 20 years to maturity 15) Consider a zero-coupon bond with 20 years to maturity. The amount that the price of the bond will change if its yield to maturity decreases from 7% to 5% is closest to: A) $118. B) -$53. C) $53. D) $673. Answer: Explanation: Following the prior logic, let’s first price the zero-coupon bond at 7%. P = $ 1,000 (1 + 7%) 20 = $ 258.42 Now at 5%: A

Consider a zero coupon bond with 20 years to maturity. Consider a zero coupon bond with 20 years to maturity 15) Consider a zero-coupon bond with 20 years to maturity. The amount that the price of the bond will change if its yield to maturity decreases from 7% to 5% is closest to: A) $118. B) -$53. C) $53. D) $673. Answer: Explanation: Following the prior logic, let’s first price the zero-coupon bond at 7%. P = $ 1,000 (1 + 7%) 20 = $ 258.42 Now at 5%: A How to Calculate Yield to Maturity of a Zero-Coupon Bond Yield to maturity (YTM) is an important metric used in bond markets that describes the total rate of return that is expected from a bond once it has made all of its future interest payments and repays the original principal amount. Zero-coupon bonds (z-bonds), however, do not have reoccurring interest payments, which distinguishes YTM calculations from bonds with a coupon rate .

Post a Comment for "39 consider a zero coupon bond with 20 years to maturity"