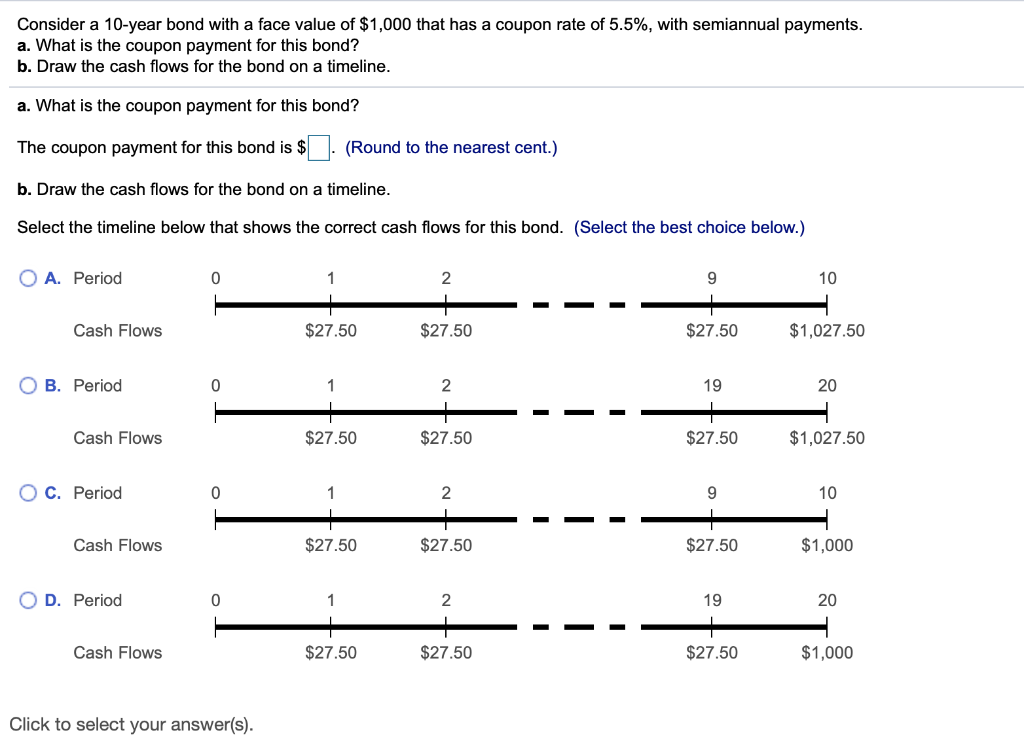

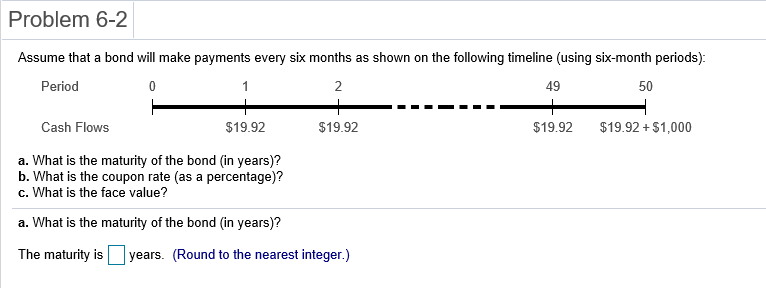

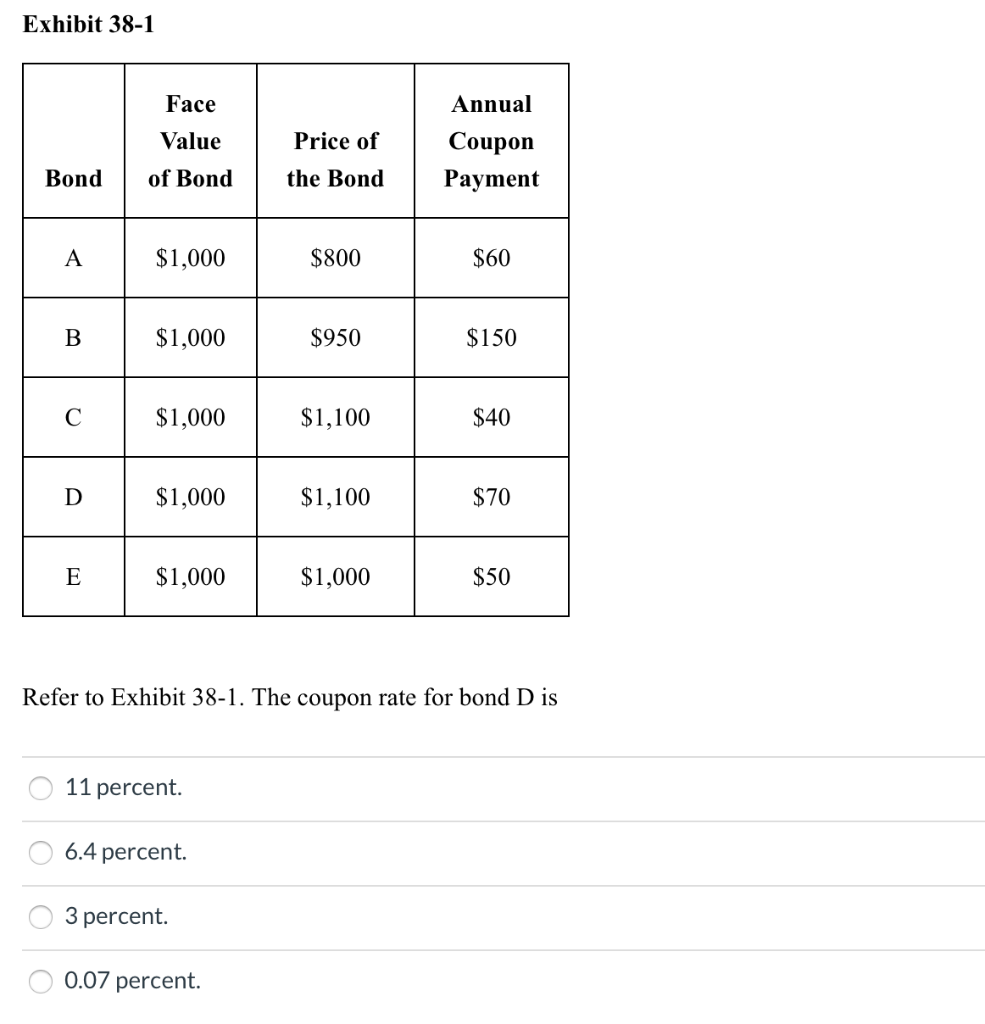

40 what is coupon payment of a bond

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus ... Coupon Payment - Investor.gov Nov 9, 2022 ... The dollar amount of interest paid to an investor. The amount is calculated by multiplying the interest of the bond by its face value.

Coupon Rate - Definition - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to ...

What is coupon payment of a bond

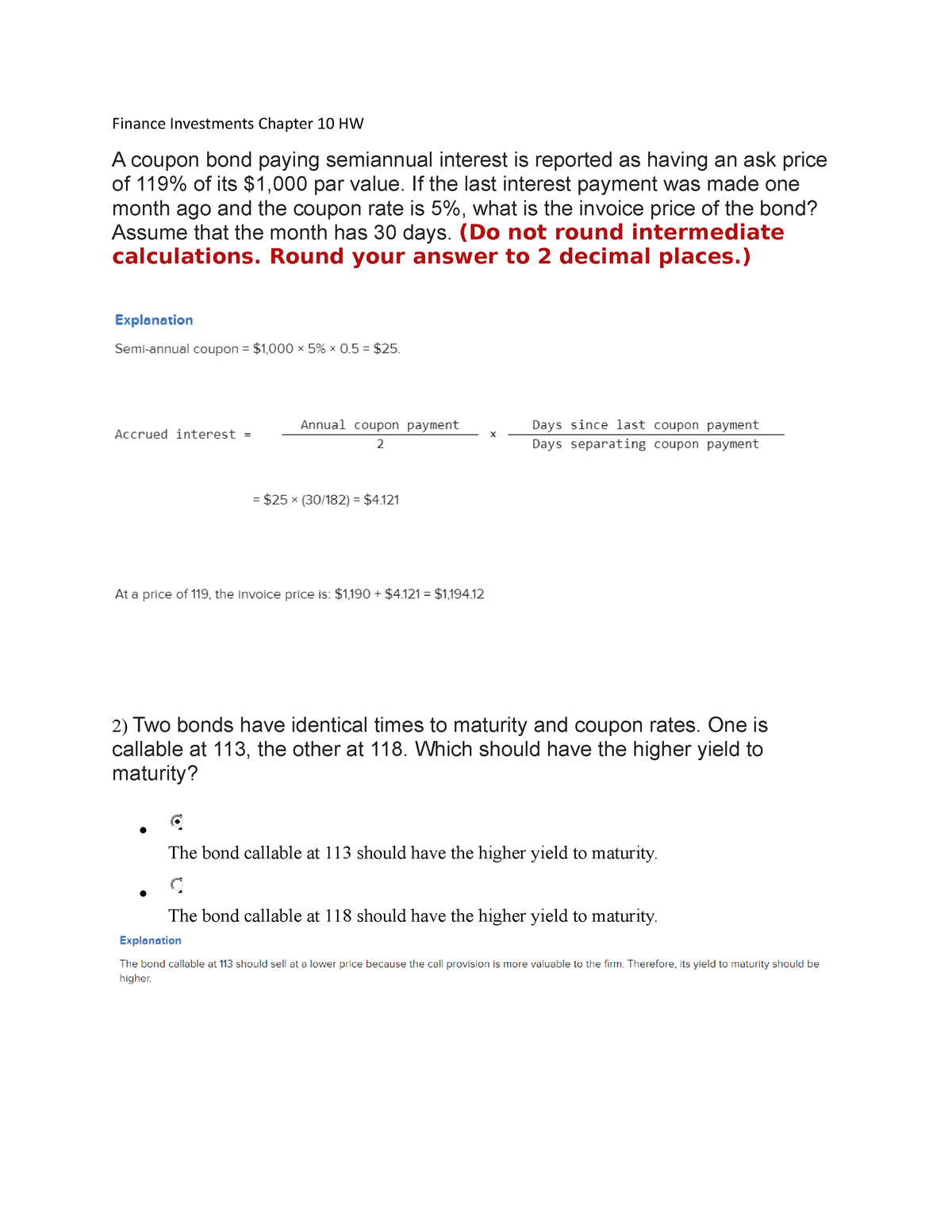

xplaind.com › 945823Coupon Payment | Definition, Formula, Calculator & Example Apr 27, 2019 · A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments. In fixed-coupon payments, the coupon rate ... What Is Coupon Rate and How Do You Calculate It? - SmartAsset.com Aug 26, 2022 ... The coupon rate is the fixed annual rate at which a guaranteed-income security, typically a bond, pays its holder or owner. › terms › zWhat Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

What is coupon payment of a bond. › terms › bBond Yield: What It Is, Why It Matters, and How It's Calculated May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... What Is a Bond Coupon, and How Is It Calculated? A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. What is a Coupon Payment? - Definition | Meaning | Example Definition: A coupon payment is the annual interest payment paid to a bondholder by the bond issuer until the debt instrument matures. Coupon Rate: Formula and Bond Calculation - Wall Street Prep The coupon rate, or nominal yield, is the rate of interest paid to a bondholder by the issuer. The pricing of the coupon on a bond issuance is used to calculate ...

› coupon-bond-formulaCoupon Bond Formula | Examples with Excel Template - EDUCBA Step 2: Next, figure out the rate of annual coupon and based on that calculate the periodic coupon payment of the bond. The coupon payment is the product of the coupon rate and the par value of the bond. It also does not change over the course of the bond tenure. The annual coupon payment is denoted by C and mathematically represented as shown ... › terms › bBond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... Guide, Examples, How Coupon Bonds Work Oct 13, 2022 ... A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during ... › coupon-bond-formulaHow to Calculate the Price of Coupon Bond? - WallStreetMojo The term “ coupon bond Coupon Bond Coupon bonds pay fixed interest at a predetermined frequency from the bond’s issue date to the bond’s maturity or transfer date. The holder of a coupon bond receives a periodic payment of the stipulated fixed interest rate. read more ” refers to bonds that pay coupons which is a nominal percentage of ...

What Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 ... A bond's coupon rate is the fixed dollar value of the annual interest the bondholder will receive. It is stated as a percentage of the ... en.wikipedia.org › wiki › Coupon_(finance)Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. For example, if a bond has a face value of ... › terms › zWhat Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... What Is Coupon Rate and How Do You Calculate It? - SmartAsset.com Aug 26, 2022 ... The coupon rate is the fixed annual rate at which a guaranteed-income security, typically a bond, pays its holder or owner.

xplaind.com › 945823Coupon Payment | Definition, Formula, Calculator & Example Apr 27, 2019 · A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments. In fixed-coupon payments, the coupon rate ...

Post a Comment for "40 what is coupon payment of a bond"