41 coupon rate for bonds

Bond Coupon Rate Definition | Law Insider bond coupon rate means % per annum, which rate shall be equal to the sum of (a) 2.95%, plus (b) the product of (i) 87% and (ii) the fixed swap rate quoted ten (10) business days prior to the issue date utilizing 3- month libor as the floating rate leg with a 15 year term as determined by the controlling person after getting market quotations from … Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

Municipal Bonds - Fidelity The advantage for issuers is that they receive a 35% federal rebate on interest costs for these bonds. BABs only subsidize an issuer's borrowing cost. There is no implied backing from the federal government. Zero-coupon bonds

Coupon rate for bonds

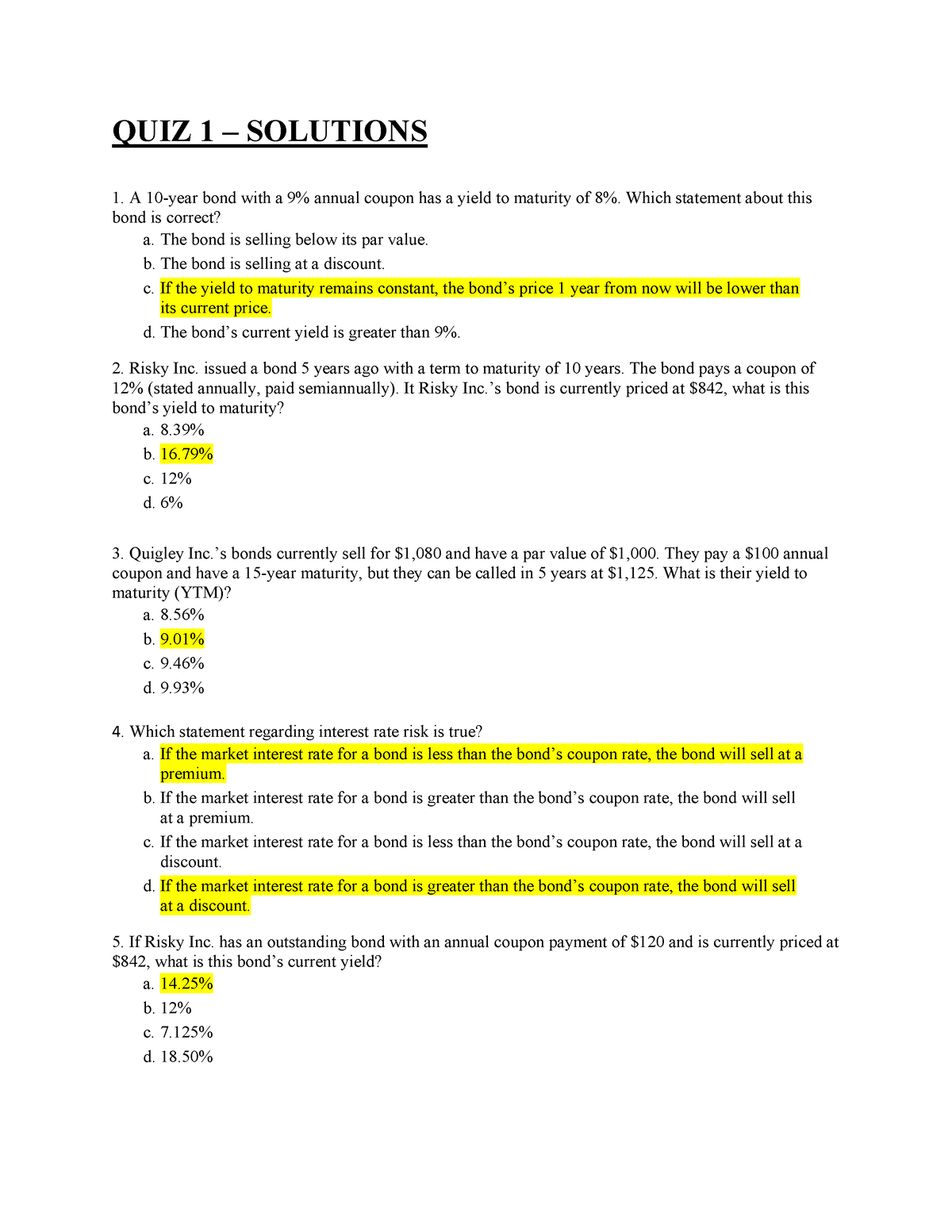

Coupon Rate Definition & Example | InvestingAnswers The coupon rate on the bond is 5%, which means the issuer will pay you 5% interest per year, or $50, on the face value of the bond ($1,000 x 0.05). Even if your bond trades for less than $1,000 (or more than $1,000), the issuer is still responsible for paying the coupon based on the face value of the bond. Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data High Yield Bonds - Fidelity High Yield Bonds High yield (non-investment grade) bonds are from issuers that are considered to be at greater risk of not paying interest and/or returning principal at maturity.As a result, the issuer will generally offer a higher yield than a similar bond of a higher credit rating and, typically, a higher coupon rate to entice investors to take on the added risk.

Coupon rate for bonds. Coupon Rate Formula | Step by Step Calculation (with Examples) Do the Calculation of the coupon rate of the bond. Annual Coupon Payment Annual coupon payment = 2 * Half-yearly coupon payment = 2 * $25 = $50 Therefore, the calculation of the coupon rate of the bond is as follows - Coupon Rate of the Bond will be - Example #2 Let us take another example of bond security with unequal periodic coupon payments. Calculate the Coupon Rate of a Bond - YouTube This video explains how to calculate the coupon rate of a bond when you are given all of the other terms (price, maturity, par value, and YTM) with the bond ... United States Rates & Bonds - Bloomberg Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA. Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Example of Coupon Rate Suppose Maxwell Ltd. has issued a bond at a par value of USD 500.00 & a coupon rate of 9% maturing in December 2024. Thus the coupon would be- Coupon = 0.09 X 500.00 = USD 45.00 This means that bondholders will get USD 45.00 every year up until 2024, i.e., the year of maturity.

Understanding Coupon Rate and Yield to Maturity of Bonds The Coupon Rate is the amount that you, as an investor, can expect as income as you hold the bond. The Coupon Rate for each bond is fixed upon issuance. Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. Coupon Rate Definition - Investopedia 28.05.2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, … How is the coupon rate of a bond calculated? - Quora Answer (1 of 3): The coupon rate is fixed when the bond is issued. It never changes. The term "coupon" is an old-fashioned term dating back to when borrowers —- Governments or Companies—- actually issued paper, bearer bonds. You'd lend the US Treasury $1000, and they would hand you an IOU with c...

Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA Let us take the example of a debt raised by ASD Inc. in the form of a bond that pays coupons annually. The par value of the bond is $1,000, coupon rate is 5% and number of years until maturity is 10 years. Determine the price of the CB if the yield to maturity is 4%. Given,Par value, P = $1,000 Coupon, C = 5% * $1,000 = $50 home.treasury.gov › interest-rate-statisticsInterest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data Bonds | FINRA.org Another rate that heavily influences a bond's coupon is the Fed's Discount Rate, which is the rate at which member banks may borrow short-term funds from a Federal Reserve Bank. The Fed directly controls this rate. Say the Fed raises the discount rate by .5 percent. The next time the U.S. Treasury holds an auction for new Treasury bonds, it ... Coupon Payment Calculator How to calculate bond coupon payment? Assuming you purchase a 30-year bond at a face value of $1,000 with a fixed coupon rate of 10%, the bond issuer will pay you: $1,000 * 10% = $100 as a coupon payment. If the bond agreement is semiannual, you'll receive two payments of $50 on the bond agreed payment dates.

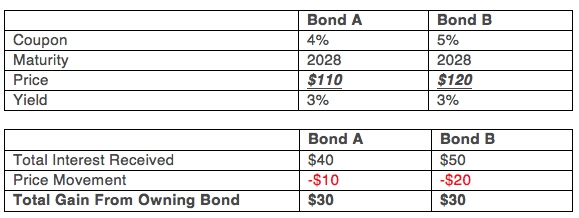

Understanding Bond Prices and Yields - Investopedia 28.06.2007 · As the price of a bond increases or decreases, the true yield will change—straying from the coupon rate to make the investment more or less enticing to investors. All else equal, when a bond's ...

Coupon Types - Financial Edge The coupon formula is 3-Month Libor + 1.2% (i.e. 2.68% + 1.2% = 3.88%). The coupon rate (3.88%) is given by the coupon formula - with quarterly interest payments. Assume that LIBOR has been fixed at 2.68%. The next coupon payment, assuming that LIBOR has been fixed at the aforesaid rate, is computed below (US$970,000).

Accounting for Bonds | Premium | Discount | Example - Accountinguide Bonds will be issued at par value when the coupon rate equal to market rate, there is no discount or premium on bond. Bonds Issue at Par Value Example On 01 Jan 202X, Company A issue 6% bond at par value of $ 100,000. The bonds will be matured in 3 years. As the market rate is also 6%, so company can issue bonds at par value.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset 26.08.2022 · b. The coupon rate is the fixed annual rate at which a guaranteed-income security, typically a bond, pays its holder or owner. It is based on the face value of the bond at the time of issue, otherwise known as the bond’s “par value” or principal.Though the coupon rate on bonds and other securities can pay off for investors, you have to know how to calculate and evaluate …

What is coupon on bonds? - moneycontrol.com Nov 24, 12:11. Coupon rate on the bonds is nothing but the rate of interest paid by the issuers to the investors on the bond's face value. The coupon rate is the annualised interest amount. Coupon ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template Enter your name and email in the form below and download the free template now! How the Coupon Rate Affects the Price of a Bond All types of bonds pay interest to the bondholder.

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds include …

Bond Coupon Interest Rate: How It Affects Price - Investopedia 18.12.2021 · But this is no less true with bonds. When the prevailing market rate of interest is higher than the coupon rate—say there's a 7% interest rate and a bond coupon rate of just 5%—the price of ...

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … In a falling rate envirnoment zero-coupon bonds appreciate much faster than other bonds which have periodic coupon payments. Bonds with a longer duration are more sensitive to the impact of interest rate shifts. Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the S&P 500 with dividends reinvested by 500% …

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia 22.03.2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve.

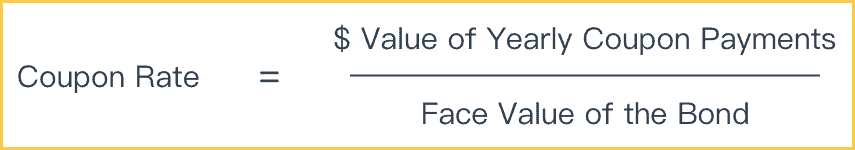

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

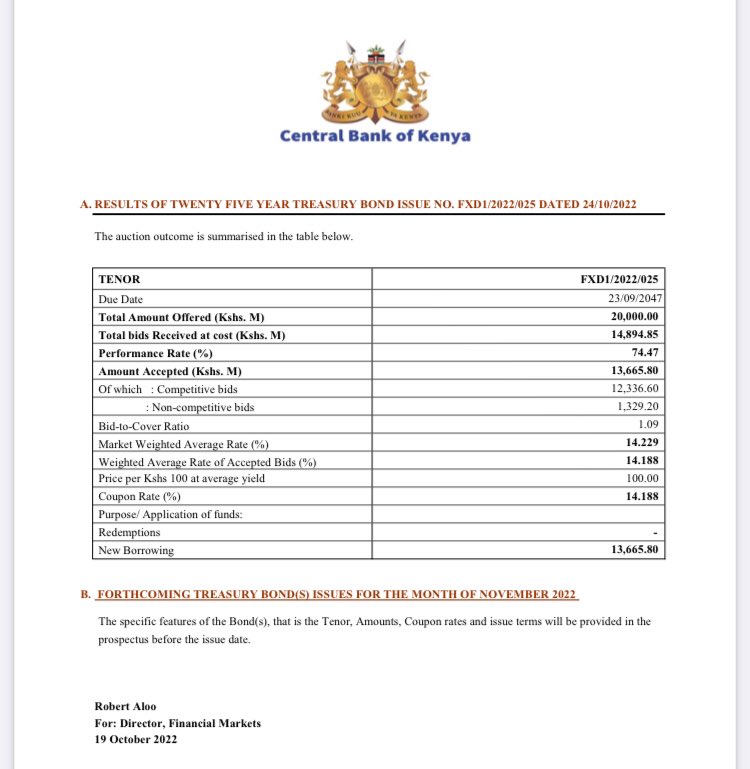

Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers.

High Yield Bonds - Fidelity High Yield Bonds High yield (non-investment grade) bonds are from issuers that are considered to be at greater risk of not paying interest and/or returning principal at maturity.As a result, the issuer will generally offer a higher yield than a similar bond of a higher credit rating and, typically, a higher coupon rate to entice investors to take on the added risk.

Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

Coupon Rate Definition & Example | InvestingAnswers The coupon rate on the bond is 5%, which means the issuer will pay you 5% interest per year, or $50, on the face value of the bond ($1,000 x 0.05). Even if your bond trades for less than $1,000 (or more than $1,000), the issuer is still responsible for paying the coupon based on the face value of the bond.

![ANSWERED] The bond has the current price of $1,123 and par ...](https://media.kunduz.com/media/sug-question/raw/66525805-1657158833.9100924.jpeg)

Post a Comment for "41 coupon rate for bonds"