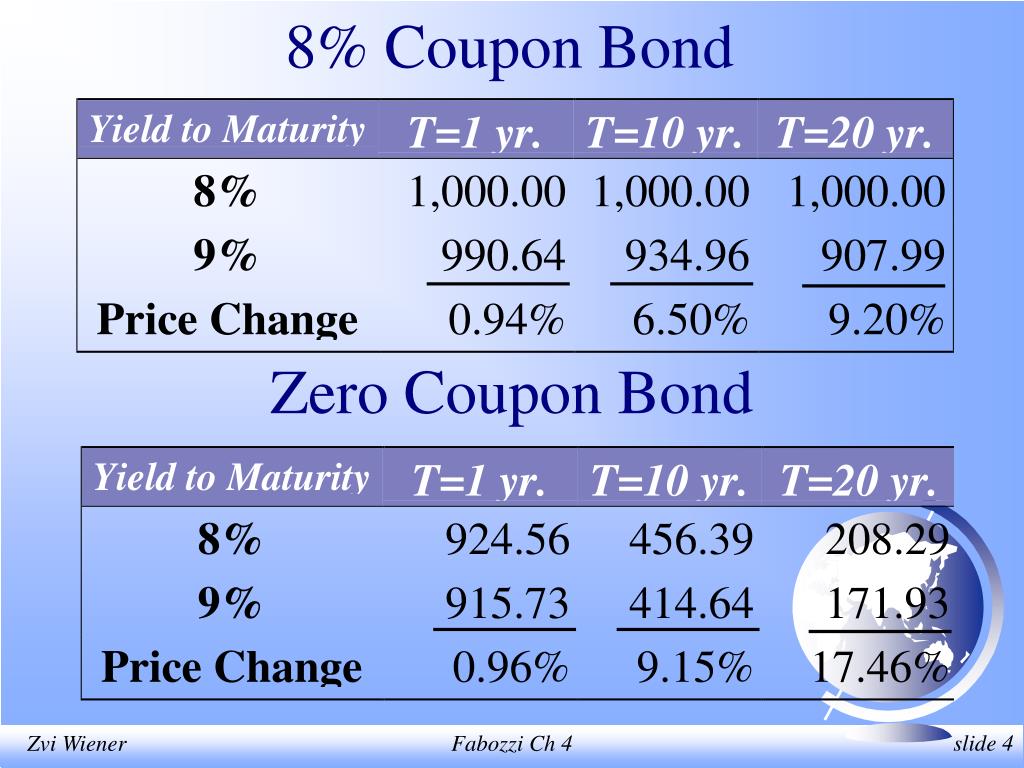

41 price of coupon bond

dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Price? - DQYDJ Zero Coupon Bond Calculator Outputs. Market Price ($): The market price of the bond, or its true value to fit the input criteria. What is a zero coupon bond? A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). Coupon Bond Formula | Examples with Excel Template Coupon Bond = $932 Therefore, the current market price of each coupon bond is $932, which means it is currently traded at discount (current market price lower than par value). Coupon Bond Formula - Example #2 Let us take the same example mentioned above.

Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today?

Price of coupon bond

budgeting.thenest.com › calculate-price-bondHow to Calculate the Price of a Bond With Semiannual Coupon ... Apr 24, 2019 · Concluding the example, adding the present values of each payment results in a total present value of $964.91. This means the bond's price needs to be $964.91 to achieve an equivalent return. If you can get a lower price, you'll enjoy a higher return, but if you have to pay a higher price, you're better off opting for the alternative investment. › finance › bond-priceBond Price Calculator | Formula | Chart May 18, 2022 · Bond price is calculated as the present value of the cash flow generated by the bond, namely the coupon payment throughout the life of the bond and the principal payment, or the balloon payment, at the end of the bond's life. You can see how it changes over time in the bond price chart in our calculator. How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Price of coupon bond. Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Bond Pricing - Formula, How to Calculate a Bond's Price A coupon is stated as a nominal percentage of the par value (principal amount) of the bond. Each coupon is redeemable per period for that percentage. For example, a 10% coupon on a $1000 par bond is redeemable each period. A bond may also come with no coupon. In this case, the bond is known as a zero-coupon bond. › bond-price-calculatorBond Price Calculator - Brandon Renfro, Ph.D. A bond’s coupon is the interest payment you receive. Use the simple annual coupon payment in the calculator. If your bond has a face, or maturity, value of $1,000 and a coupon rate of 6% then input $60 in the coupon field. Compounding Frequency. For most bonds, this is semi-annual to coincide with the fact that you receive two annual coupon ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... In a falling rate envirnoment zero-coupon bonds appreciate much faster than other bonds which have periodic coupon payments. Bonds with a longer duration are more sensitive to the impact of interest rate shifts. Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the S&P 500 with ...

exploringfinance.com › bond-price-calculatorBond Price Calculator - Exploring Finance Bond face value is 1000; Annual coupon rate is 6%; Payments are semiannually; What is the bond price? You can easily calculate the bond price using the Bond Price Calculator. Simply enter the following values in the calculator: Once you’re done entering the values, press on the ‘Calculate Bond Price’ button, and you’ll get the bond ... What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities. Advantages and Risks of Zero Coupon Treasury Bonds If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. The recipient, on the other hand, will receive... Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

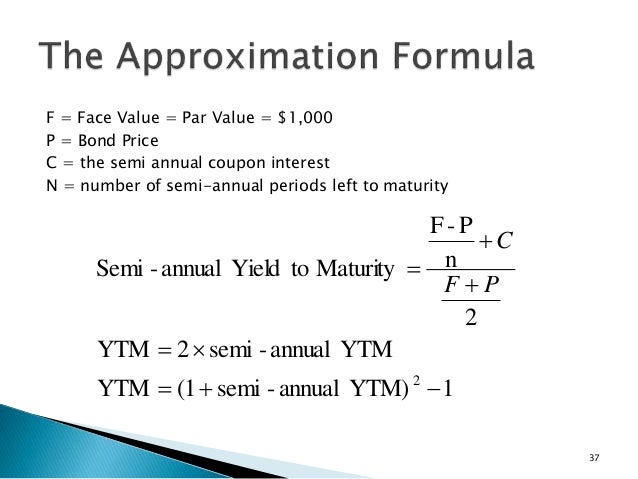

Zero-Coupon Bond: Formula and Excel Calculator Price of Bond (PV) = $554 We can enter the inputs into the YTM formula since we already have the necessary inputs: Yield-to-Maturity (YTM) = ($1,000 / $554) ^ (1 / 20) - 1 YTM = 3.0% The 3.0% yield-to-maturity (YTM) matches the stated assumption from the earlier section, confirming our formulas are correct. Continue Reading Below Coupon Bond Formula | How to Calculate the Price of Coupon Bond? The price of each bond is calculated using the below formula as, Therefore, calculation of the Coupon Bond will be as follows, So it will be - = $838.79 Therefore, each bond will be priced at $838.79 and said to be traded at a discount ( bond price lower than par value) because the coupon rate is lower than the YTM. Coupon Bond - investopedia.com Typical bonds consist of semi-annual payments costing $25 per coupon. Coupons are usually described according to the coupon rate. The yield the coupon bond pays on the date of its issuance is... dqydj.com › bond-pricing-calculatorBond Price Calculator – Present Value of Future Cashflows - DQYDJ Days Since Last Payout - Enter the number of days it has been since the bond last issued a coupon payment into this field of the bond pricing calculator. Coupon Payout Frequency - How often the bond makes a coupon payment, per year. If it only pays out at maturity try the zero coupon bond calculator, although the tool can compute the market ...

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate ...

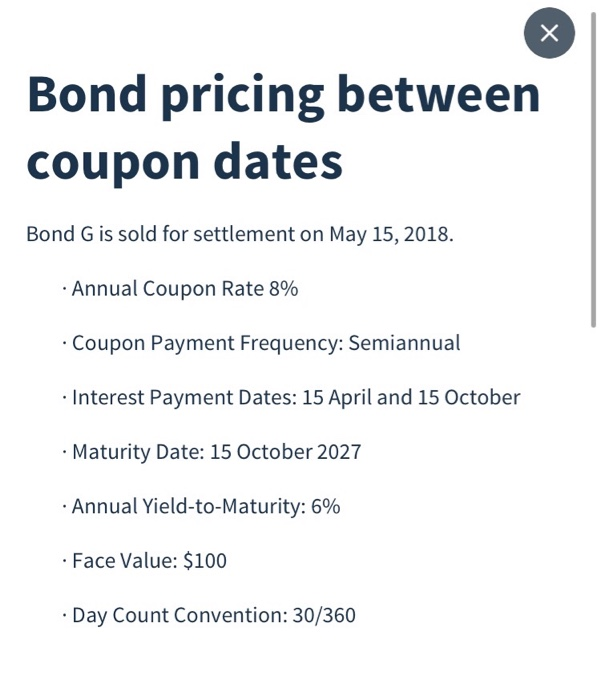

Individual - Treasury Bonds: Rates & Terms Premium (price above par) 30-year bond reopening. Issue Date: 9/15/2005. 3.99%. 4.25%. 104.511963. Above par price required to equate to 3.99% yield. Sometimes when you buy a bond, you are charged accrued interest, which is the interest the security earned in the current semiannual interest period before you took possession of the security.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%). If the price of the bond falls to $800, then the yield-to-maturity will change from 2% to 2.5% ( i.e., $20/$800= 2.5%). The yield-to-maturity only equals the coupon rate when the bond sells at face value.

Pricing bonds with different cash flows and compounding frequencies Equation 1 defines the value of a bond that pays coupons on an annual basis and a principal at maturity. The value of a bond paying a fixed coupon interest each year (annual coupon payment) and the principal at maturity, in turn, would be: ... Lower-quality fixed income securities involve greater risk of default or price changes due to ...

United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. Skip to content. ... Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month . 0.00: 1.54: 1.56% +59 ...

Coupon Rate Definition A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

Bond Coupon Interest Rate: How It Affects Price - Investopedia A $1,000 bond has a face value of $1,000. If its coupon rate is 1%, that means it pays $10 (1% of $1,000) a year. Coupon rates are largely influenced by prevailing national government-controlled...

What Is the Coupon Rate of a Bond? - The Balance ABC bond's coupon rate was 3%, based on a par value of $1,000 for the bond. This translates to $30 of interest paid each year. Let's say Investor 1 purchases the bond for $900 in the secondary market but still receives the same $30 in interest. This translates to a current yield of 3.33%.

Bond Price Calculator Let's assume that someone holds for a period of 10 years a bond with a face value of $100,000, with a coupon rate of 7% compounded semi-annually, while similar bonds on the market offer a rate of return of 6.5%. Let's figure out its correct price in case the holder would like to sell it: Bond price = $103,634.84

› bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years.

Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond...

What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Eurofins Successfully Prices New €600m 7-Year 4%-Coupon Senior ... The Bonds have a 7-year maturity (due on 6 July 2029) and will bear an annual fixed rate coupon of 4%. The transaction was well received and was more than 2.3x over-subscribed. As announced this ...

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

› finance › bond-priceBond Price Calculator | Formula | Chart May 18, 2022 · Bond price is calculated as the present value of the cash flow generated by the bond, namely the coupon payment throughout the life of the bond and the principal payment, or the balloon payment, at the end of the bond's life. You can see how it changes over time in the bond price chart in our calculator.

budgeting.thenest.com › calculate-price-bondHow to Calculate the Price of a Bond With Semiannual Coupon ... Apr 24, 2019 · Concluding the example, adding the present values of each payment results in a total present value of $964.91. This means the bond's price needs to be $964.91 to achieve an equivalent return. If you can get a lower price, you'll enjoy a higher return, but if you have to pay a higher price, you're better off opting for the alternative investment.

Post a Comment for "41 price of coupon bond"